gut;1397483 wrote:LMAO. Why not? You've been bukkaked with keynesianism.

Obamacare => +$6.4T added to future deficits. But, no, there have been any spending increases.

Still doesn't answer the question - $800B+ a year in higher spending and STILL we've had a subpar recovery, to put it mildly. Where are all these magical benefits of keynesianism you keep pontificating about?

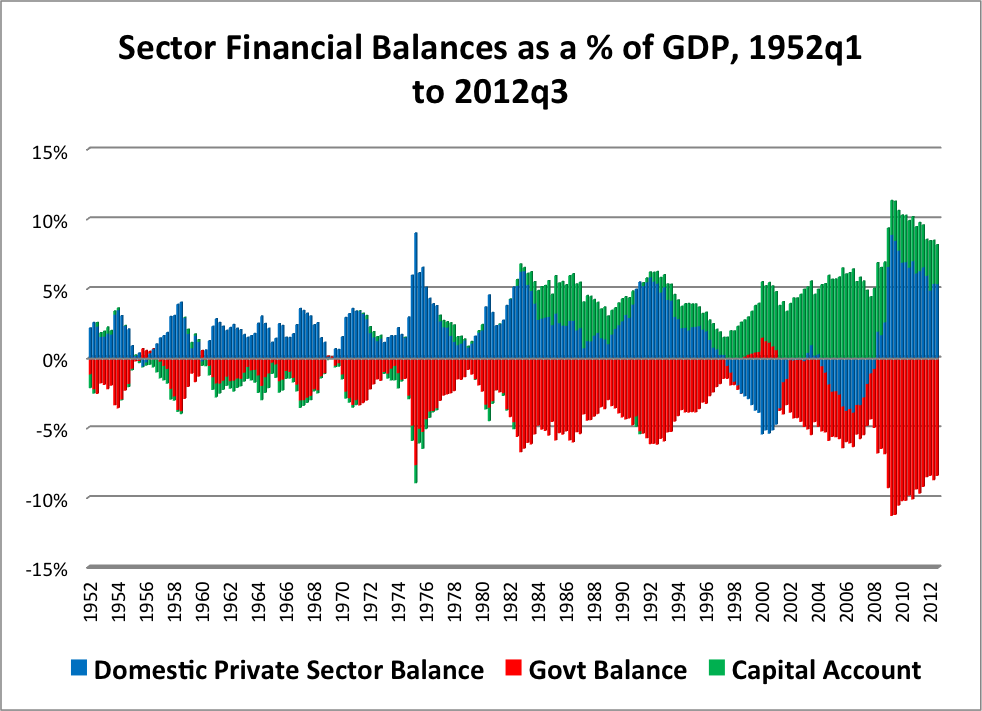

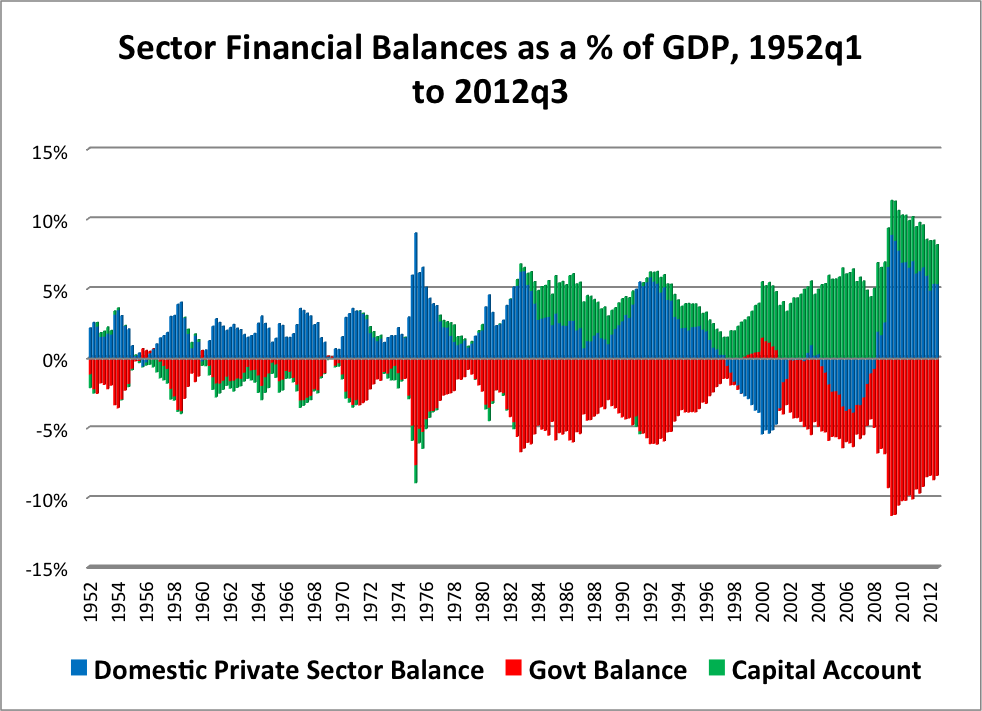

Why Not?? Because it's an accounting identity. In the sectoral balances model The Government Sector, the Private Sector and the Foreign Sector cannot all be in surplus at the same time.

Look at what happened in the late 90's when the federal government was running a surplus...the domestic private sector balance was in deficit.

So if you're going to have huge capital account surpluses and domestic private sector surpluses and state governments in surplus a lot...there's going to have to be a federal deficit.

And yes, I did answer it...that $800 billion per year paid out in food stamps, etc. is ok because it at least supports demand but it's not even compensation for services rendered...We don't pay in exchange for production. But it is better than nothing. A better thing to do would be a full payroll tax holiday as it increases demand while also providing more compensation for people who are working.

Even though that seems like a lot the U.S. Economy is huge! It's just not enough to overcome the desired savings occuring in the state governments and the domestic private sector when you consider the size of our whole economy.

We can see the results clearly. the UK, a country with its own sovereign currency like us chose seeking a balanced budget from the get go...on their way to a 3rd recession. The U.S. has had deficits and a milder approach toward a balanced budget as the deficit has come down every year but not that greatly...a meager and slow recovery

Going

more in the UK direction as we've done with the payroll tax raise, marginal tax rate raise on the rich and now with the sequester...is going to lead to an economy more like the UK's...shittier...

Going more in the opposite direction would lead to a better recovery.

Is there any doubt that if the payroll tax cut had been extended that the economy would be doing better?? The same holds true from spending cuts that take money out of people's pockets. (That is of course unless conservatives are right and spending cuts inspire other private sector actors to spend more. I'm anxious to see the response when this does not occur. If it does I will eat crow).