fan_from_texas;1211407 wrote:What do you think of earnings-indexed student loans? I believe Australia has (or is experimenting with) them. The basic idea is that the interest rate you pay is based on your income. I think there are some potential moral hazards vis-a-vis people going into low earning majors (art history, anyone?), but this is one way to take a bit of the risk off a 17 year-old.

Don't get me wrong; I think people should be held accountable for mistakes. At the same time, it seems a bit unreasonable to take a 17 or 18yo student who follows the (terribly misguided) advice of their parents/guidance counselor/any Boomer to "go to college and study what [they] love", then ends up without a job and with a ton of debt.

If we want to hold kids accountable for their decisions, shouldn't we either lessen the risk somehow or make sure they're getting better advice?

I think that could work in conjunction with a real accounting of graduates' income and tie any monetary gain from universities from federal subsidies back to any "bail-outs" (for lack of better term) of forgiveness of student debt.

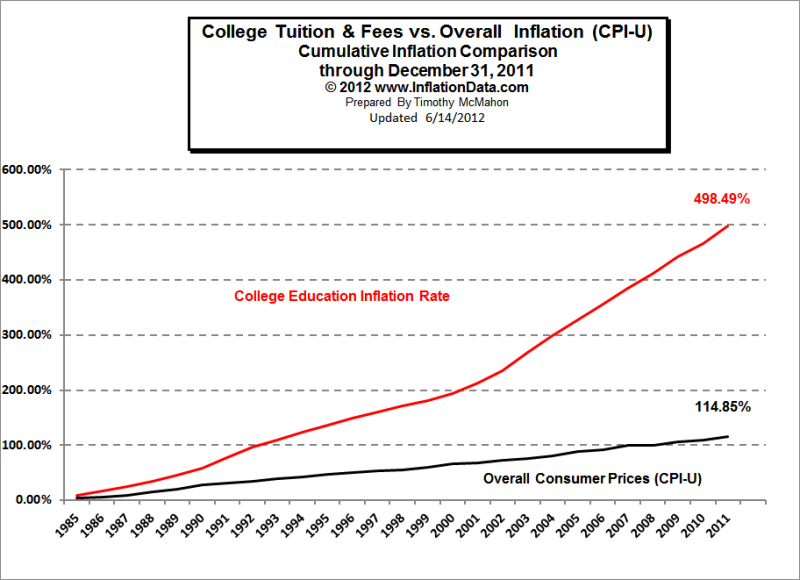

The key issue, IMO, is that the cost of higher education has not only outpaced inflation, value of degree, etc., in the last 10 years or so, but also has done so in a multiple manner. We've created an education industrial complex based on funny money in guaranteed student loans, large entities that can't control their spending, and an ultimately diluted if not worthless product. Since this is the political board I can say this - I don't see much headway in the next few years since the academic industrial complex tends to heavily lean DEM.

As most people that read my posts know, one of my alma mater's is a "state" institution that in my last year of school had an OOS tuition of about $19,500. That was 1998-9 year. Today that number is around $45,000 (I don't care to look it up). That is insane. Where is this money going? There have been improvements made to the physical plant, but not that much. The stock market/inflation hasn't kept up nearly with that - the job prospects aren't just worse, they are (again) a multiple of said worse. This makes no sense.

The taxpayers are asked to subsidize a growing monster that could eclipse the housing bubble depression of the 2000's. This isn't just economics. Someone that lost $400,000 on an investment house in Las Vegas can foreclose. You can't foreclose on student loans. We have a growing young population that can't afford to even get their own apartment by age 30, let alone marry, have children, or otherwise be a productive adult. That just isn't an economic disaster, it is a sociological disaster.

I'm not sure what the best answer is, but getting our (incompetent) federal government out of the student loan subsidization business might be a fine start.