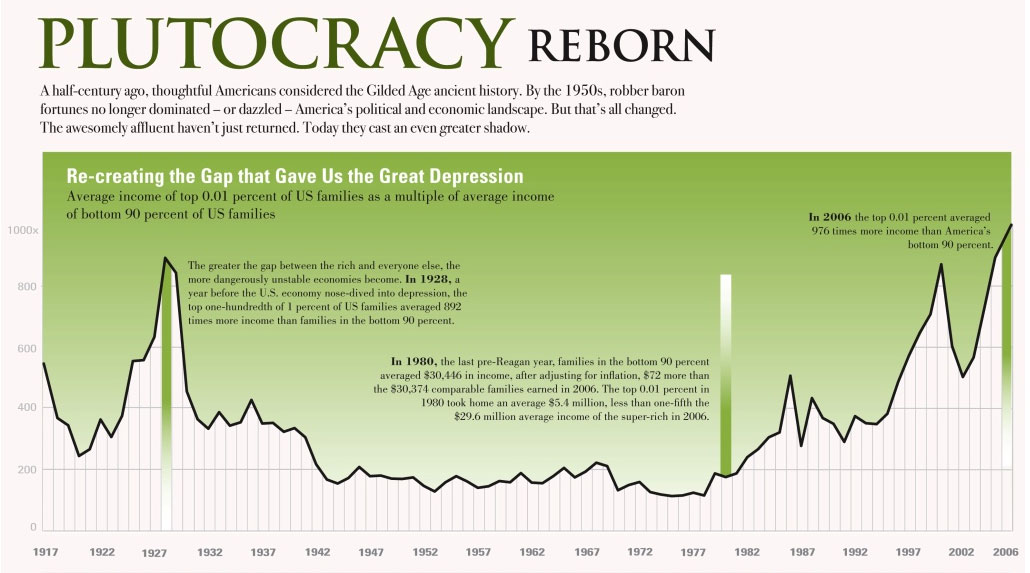

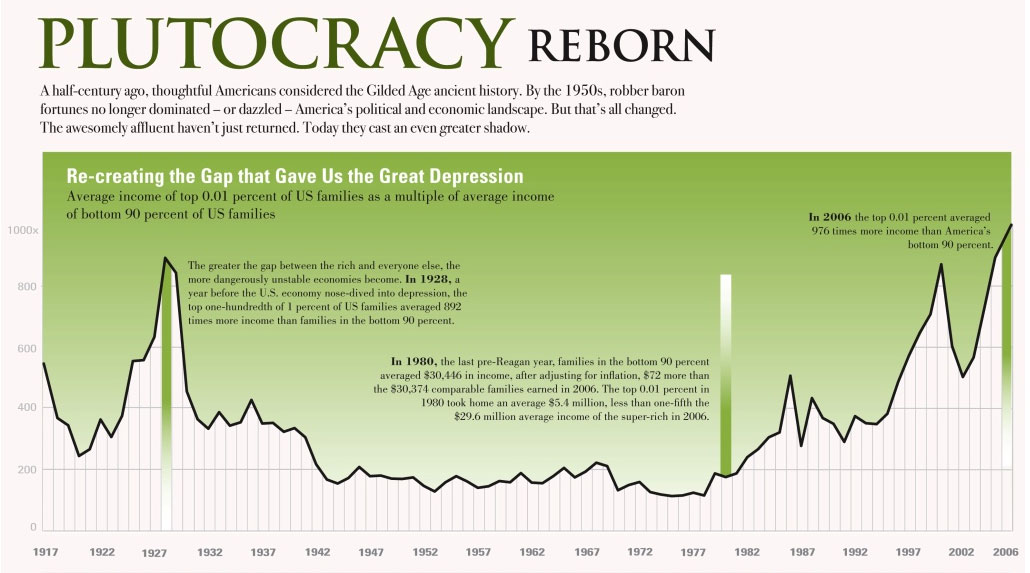

BoatShoes;815907 wrote:The sad thing is I gather from your posts that you consider yourself an Austrian and yet you are totally unaware of their major contribution to mainstream economic theory with the marginal revolution. There's no point into posting all of it again as I've posted it over again. You also seem unaware of the reality of compounding of economic growth over the years as the only ones seeing significant growth since 1975 when a CEO's pay was 3 times the average worker and is now 400 times the average worker. That bottom 50% in your table would gladly pay more taxes if it meant that their pay was in its former ratios.

But as to the law of diminishing marginal utility which, even if higher income earners are paying a larger percentage of their income, still stipulates that they are giving up far less utility to the government.

wealth and income inequality reduces the sum total of personal utility because of the decreasing marginal utility of wealth. For example, a house may provide less utility to a single millionaire as a summer home than it would to a homeless family of five. The marginal utility of wealth is lowest among the richest. In other words, an additional dollar spent by a poor person will go to things providing a great deal of utility to that person, such as basic necessities like food, water, and healthcare; meanwhile, an additional dollar spent by a much richer person will most likely go to things providing relatively less utility to that person, such as luxury items. From this standpoint, for any given amount of wealth in society, a society with more equality will have higher aggregate utility. Some studies (Layard 2003;Blanchard and Oswald 2000, 2003) have found evidence for this theory, noting that in societies where inequality is lower, population-wide satisfaction and happiness tend to be higher.

It is also erroneous to solely focus on income because, as noted before, the compounding growth in conjunction with decreasing tax rates for higher income earners has allowed those very rich to expand their net worth tremendously so has to have 80% of the wealth of this country (assets - liabilities).

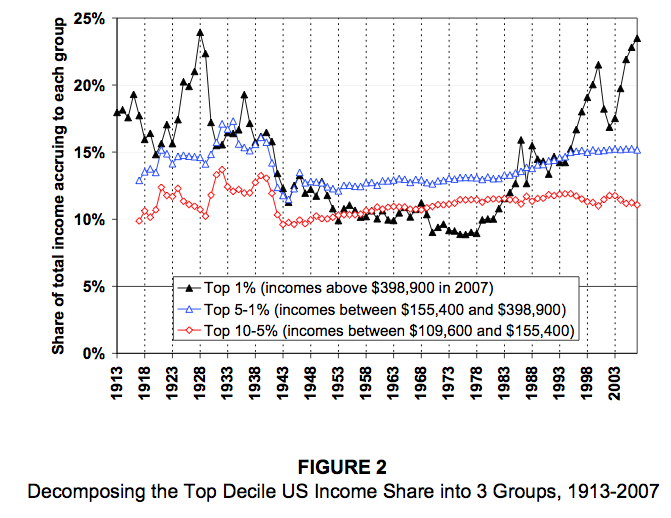

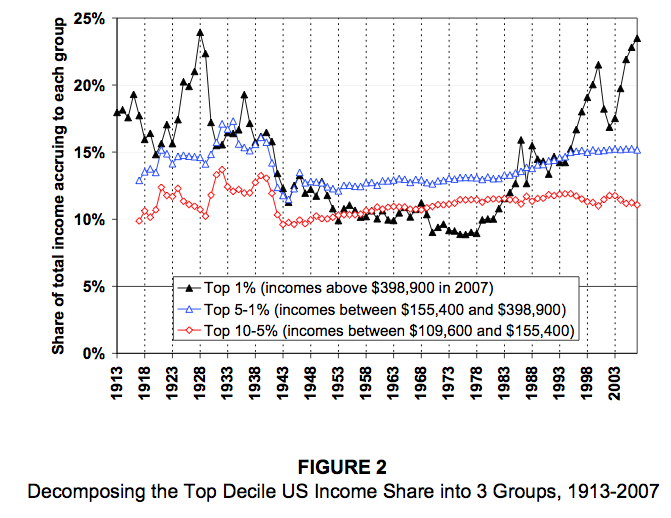

You also fail to point out the even more telling factoid of your chart...the massive inequality between the top 1% and .1% between even the top 5% because the top 5% are often ordinary income earners whereas those in the higher percentages have a lower effective rate in the form of capital gain and qualified dividends.

Overall, no one disputes that the wealthier pay more taxes but when the top 10% earns 45% of the nation's income and the bottom 50% earns 12.7% and those ratios get farther and farther apart compounding over 20 years,

combined with the catechism that you could never raise taxes on that bottom 50% of course they're not going to pay taxes. Once the bush tax cuts are about to expire again a Conservative will be on here talking about the largest tax increase in history...and then a month later talk about how no one pays taxes.

I mean MajorSpark did taxes for a guy who earns $50k a year and he got a tax refund....you saying those kinds of hard working families who haven't had their wages rise in 20 years wouldn't love to pay some taxes if he got a $30,000 raise...and his wife probably works too!

I mean, are you really proposing that we raise the taxes on the bottom 50% of americans? Go ahead and propose it...Especially when they get so much more utility out of their dollars....that 10% of their AGI that they keep is going purely towards consumption for most of them

as evidence by the lack of saving over the last 20 years.

You want the bottom 50% to pay more taxes but you will not support any policies that would increase their hiring...you do not demand that their bosses who use essentially slave labor instead and earn 400 times what they do pay them higher wages. You decry labor unions despite Taft-Hartley bringing along the snow ball of the steady demise of the American middle class.

Again, I'm sure you're going to talk to me about the worthless bums who stroll into my gf's bank to get their SSI check...as if that is the source of our problems.

I mean it makes no sense to focus solely on income.

Dr. John Rutledge, an economist, was one of the principal architects of the Ronald Reagan economic plan in 1980-81 and was an advisor to the George W. Bush White House on tax policy. He now runs his own private equity investment firm. He did an analysis of the Fed's z1 form which tracks the balance sheet of the U.S. economy. In the awful year that was 2008 our people had

188 trillion dollars worth of national assets. That dwarfs our national debt and is a better ratio than countless successful businesses...but yet we're hearing cries of our impending bankruptcy...because our debt is approaching our yearly national income. Add in that $141 trillion of those assets are financial assets.

Most of our people as individuals have negative net worth let alone debt greater than their annual income!

Most of our people as individuals have negative net worth let alone debt greater than their annual income!

Now think about that...The top 10% have control over 93% of $141 trillion worth of financial assets. They have so much money that it has incredibly low utility in comparison to the average american. They don't even feel the pain of their taxes in the same way most taxpayers do if they lose a $10 bill. This is basic economics and the thing that put the Austrian School on the map.

http://3.bp.blogspot.com/_RSMVZRZECdI/TNGDgmEht5I/AAAAAAAACGI/E1veBkaNkqM/s400/wealth.distribution.2007.graph1.gif

The bottom line is this: The United States is the most powerful nation the world has ever known and it was founded upon a merit conception of justice...that people are rewarded for what they earn and produce as free individuals with rights bestowed from God. America's workers are our producers...that bottom 80% with no wealth to speak of...are among the most talented and skilled and educated and productive that you will find, despite the lack of investment in their education each and every year and nearly all of them besides the glaring examples we're all too well aware of...aren't looking for a handout and never have. Yet, since 1975...despite working just as hard and growing our economy throughout that time....they have not been rewarded for their efforts...And despite, if we were to look at our national balance sheet which is not dire at all (as opposed to our yearly debt to income ratio)...the national debate has centered around destroying medicare and raising their taxes because high income earners (which includes a miniscule percent of the tea party) are "taxed enough already" when that clearly is not the case if you consider, aggregated wealth, compounding of wealth over years and the law of diminishing marginal utility.

Most of America is on hard times but a very few don't have a care in the world and they are the one's with all of the power and both the democrats and republicans are in their back pocket. But I dunno...it's like Peter Finch said in the film network...we come home and we turn on our tube's...these days the internet, and we have the whole world at our fingertips and maybe we just don't care.

Apologies for the long reply as you won't be convinced anyway. I'll take some inadequate health care vouchers and lose my tax expenditures so George Soros can have a 0% Tax Rate on his income and we can have a balanced budget 30 years from now! Maybe he will spend it on a SuperPAC!