jmog;1597626 wrote:I think you completely missed the point. Iost certainly believe welfare handouts and wealth transfers hurt economic growth.

And when did you stop being a tax/spend, Obama apologist, progressive? Do you really think the programs you are saying will fix things AREN'T wealth transfers? Where is the money coming from to pay for them?

1. I've always been pro-tax cutting and pro-spending because I support bigger deficits and I've never been an "Obama apologist". I defend Obama against the absurd hyperbole on this forum and don't think he's a complete incompetent no-nothing but that makes me an "Obama nuthugger" in this place where people act call him the worst president in history.

Everybody in Washington is wrong because they're deficit hawks when they should be full employment hawks. The democrats are only less bad than the hard money deficit obsessives encapsulating today's conservative movement and republican party.

I am way "to the left" of either party in today's political spectrum. Democrats have bought into the insane, perpetually false doomsday prophecies of the conservatives and are only slightly less bad. Basically everything the Democrats propose (despite being inadequate) is better than the Republicans because they're completely off the map. That's it and that's all.

2. The United States has the Power of the Purse. Taxes don't fund government spending. The Founding Fathers gave the Federal Government the Power to Coin Money and Regulate the Value Thereof. The Treasury doesn't need your money to hire public employees and buy the output of the unemployed masses. The Federal Government levies taxes to ensure that the U.S. dollar is the unit of account and to regulate the economy and subtract purchasing power as a buffer against inflation. That's part of the problem. We have to get rid of the notion that taxes are redistributed to other people. That's impossible.

U.S. dollars are a claim on the Federal Government just like a U.S. Treasury Security. If you have a claim on a bank that is denominated in U.S. dollars and the Federal Government taxes it away, it destroys that claim forever. There is no such thing as wealth redistribution through taxation.

The government doesn't need your money to pay for shit. It takes some of it to make sure that it's expenditures don't cause inflation. Under current conditions, with high unemployment and low inflation we should be cutting taxes and increasing spending. I say cut employer and employee payroll taxes to zero.

Either way. Studies on the Job Guarantee show it only costs 1-3% of GDP. Current Means-Tested Welfare Programs cost 5% of GDP. Even in a country with a Gold Standard or the State's where the government needs tax money to fund expenditures, a Job Guarantee would still be better.

3. And no, it's not a transfer just like the paying of an E-1 soldier is not a "transfer", it is compensation for services rendered and counted in the GDP equation as Government Consumption whereas handouts like EBT deposits are not.

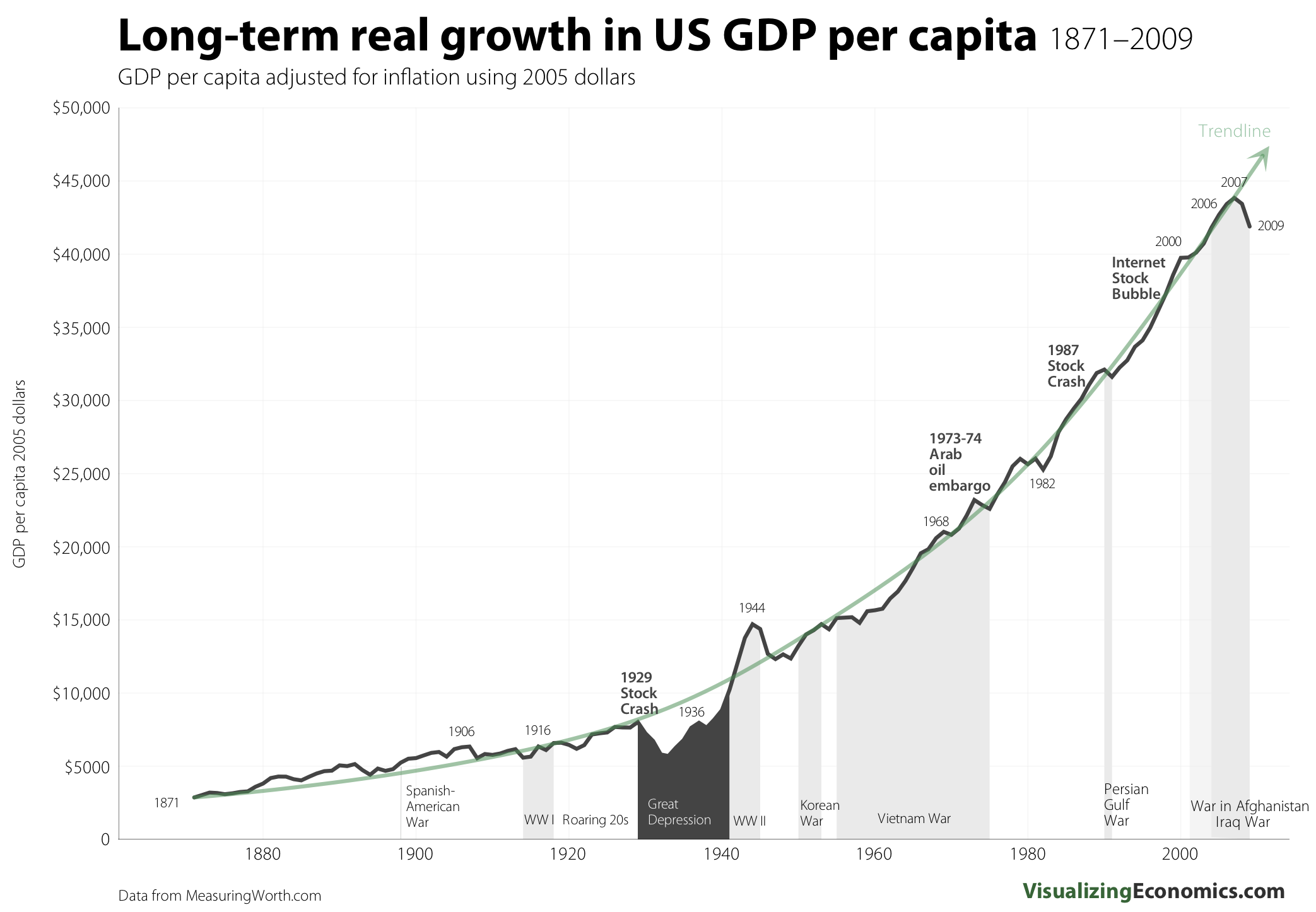

4. I did not miss the point. You missed the point by posting that graph thinking I was somehow suggesting that the United States hadn't had economic growth in the general sense.

ay fees for environmental assessments and to get permits just to till the soil near gullies, ditches or dry streambeds where water only flows when it rains.”

ay fees for environmental assessments and to get permits just to till the soil near gullies, ditches or dry streambeds where water only flows when it rains.”