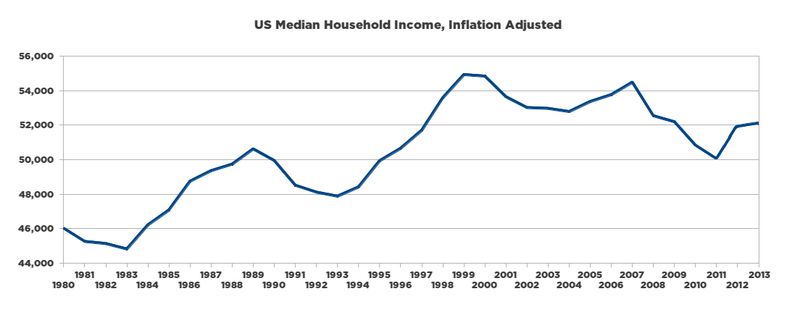

Al Bundy;1571137 wrote:We have had 5 years of Obama's leadership. During that time, the stock market has more than doubled while the median income has dropped by 7%.

Without going into the "anti-business" agenda, what has kind of happened is QE turned investments upside down - i.e. the juiced returns on existing assets (i.e. stocks, bonds, etc...) necessarily raises the minimally acceptable return on new investments.

I think maybe it's time to look at further differentiating capital gains tax on new vs. existing investments. You have a little benefit in the tax code with regard to depreciation of equipment, but with more and more businesses service-based and most of their costs business development/labor... I'm not sure how you differentiate, but capital gains from the stock market should be like a 28% tax rate and that on new investments should be 15% (maybe less).

Or maybe what this all points to is lower marginal corporate rates and higher capital gains. Done correctly, the net "double taxation" to an investor would remain the same but would better align risk/return on new investments. I'm thinking a company getting market returns on $1B of cash on its books would pay a rate of 28%, but maybe business profits would only be taxed at 20%.